Description

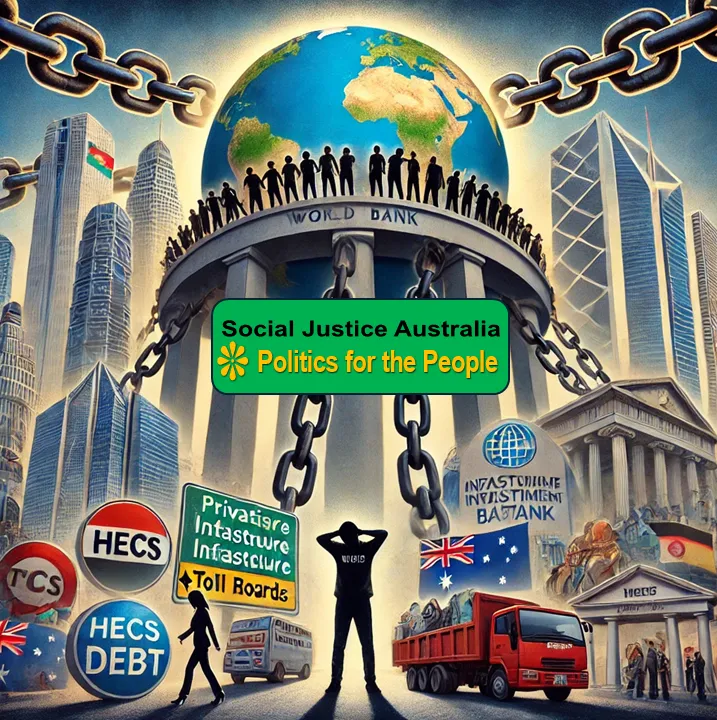

World Bank alternatives. Discover why nations are turning away from the World Bank and exploring fairer, development-focused financial alternatives. Learn how they’re regaining control.

Introduction: The Trap of World Bank Dependency

1982 Mexico defaulted on its foreign debt, triggering a global economic crisis. Desperate for financial stability, the country turned to the World Bank. The result? A series of harsh structural adjustment programs dismantled public services, privatised industries, and left the economy vulnerable to multinational corporations.

This story is not unique. From Argentina to Ghana, Bolivia to Indonesia, countries have found themselves trapped in cycles of debt dependency, forced to implement austerity measures that worsen poverty and inequality. However, as the world shifts away from neoliberal economic policies, new World Bank alternatives are appearing, offering nations a way to regain monetary sovereignty without harsh conditions.

While not financially dependent on the World Bank, Australia has also been influenced by its economic ideology, leading to privatisation, deregulation, and higher costs for essential services. Understanding these influences is key to reclaiming economic policies that help Australians rather than corporations.

The Problem with World Bank Lending and Influence

1. Structural Adjustment Programs (SAPs): Austerity Disguised as Aid

Since the 1980s, the World Bank and the International Monetary Fund (IMF) have imposed SAPs as loan conditions. These policies include:

Since the 1980s, the World Bank and the International Monetary Fund (IMF) have imposed SAPs as loan conditions. These policies include:

• Privatisation of public assets – Selling off national infrastructure, energy companies, and water supply to multinational corporations.

• Cuts to social spending – Reducing public healthcare, education, and welfare.

• Market liberalisation – Opening economies to unrestricted foreign investment, often harming local businesses.

• Labour deregulation – Weakening workers’ rights and protections.

These policies have resulted in rising inequality, economic stagnation, and social unrest in many countries.

2. The Debt Cycle: A Never-Ending Burden

Many countries take World Bank loans to fund infrastructure projects or stabilise their economies. However, these loans have high-interest rates and policy conditions that make repayment difficult. As a result, countries are often forced to take out more loans to pay off earlier debts.

3. World Bank Influence in Australia

As a developed nation, Australia does not rely on the World Bank for loans, but it is still influenced by the institution’s economic policies and global financial strategies.

A. Privatisation of Public Services

• Inspired by World Bank-backed neoliberalism, Australia privatised roads, energy grids, telecommunications, and public transport.

• Result: Higher consumer costs and foreign corporate ownership of essential infrastructure.

B. HECS Debt and Higher Education Costs

• The World Bank recommends ‘cost-sharing’ models for university education, shifting financial burdens to students.

• Australia followed this model by introducing HECS debt, replacing free university education.

• Impact: A generation of Australians burdened by student loans.

C. Foreign Investment and Housing Crisis

• World Bank-backed market liberalisation has encouraged foreign investment in Australian property, driving up housing costs.

• Impact: Housing unaffordability for ordinary Australians while corporate investors profit.

Emerging Alternatives to the World Bank

1. BRICS New Development Bank (NDB): A Fairer Approach

• Established in 2015 by Brazil, Russia, India, China, and South Africa (BRICS).

• Offers low-interest loans for infrastructure and sustainable development without requiring austerity measures.

• Example: NDB has funded clean energy projects in Brazil and railway expansion in India, boosting regional economies without privatisation demands.

2. Asian Infrastructure Investment Bank (AIIB): Redefining Global Finance

• Founded in 2016, led by China, with over 100 member countries.

• Prioritises infrastructure projects in Asia, Africa, and Latin America.

• Example: AIIB invested in Bangladesh’s power grid expansion, improving access to electricity without forcing government budget cuts.

3. Banco del Sur: A Latin American Solution

• Created by Argentina, Venezuela, Brazil, and other South American nations.

• Aims to finance regional economic development without the IMF’s restrictive conditions.

• Example: Funded social housing projects in Ecuador and Venezuela, reducing homelessness without imposing austerity.

How Australia Can Reduce World Bank Influence

To reclaim economic sovereignty, Australia should:

1. Reinvest in Public Services – Reverse privatisation and reinstate public ownership of essential services.

2. Expand Public Banking – Support state-owned banks to reduce corporate financial dominance.

3. Redirect Public Money Toward Free Education – Phase out HECS debt and reinstate fully funded university education.

4. Implement Stronger Housing Regulations – Reduce foreign corporate ownership of housing to improve affordability for Australians.

Conclusion: The Path to Economic Sovereignty

For decades, the World Bank has dictated global economic policies, influencing even developed nations like Australia through its privatisation, deregulation, and corporate-friendly policies.

However, new financial alternatives and domestic economic reforms offer opportunities for Australia to reclaim control over its economic future. By shifting away from World Bank-aligned policies, Australia can invest in sustainable, fair growth—prioritising citizens over corporate profits.

Q&A: Common Reader Questions

1. Is it realistic for countries to stop using the World Bank?

Countries like China, Bolivia, and Argentina have successfully reduced their reliance on World Bank funding through regional banking initiatives and public financing.

2. How has the World Bank influenced Australia’s economy?

Australia has followed World Bank-backed privatisation, deregulation, and student loan models, leading to higher costs for essential services.

3. What can Australians do to resist the World Bank’s influence?

Supporting public banking, stronger housing regulations, and free education policies can help shift Australia’s economy away from corporate-driven models.

If you found this article insightful, explore more on political reform and Australia’s monetary sovereignty at Social Justice Australia. :https://socialjusticeaustralia.com.au/

Share this article with your community to help drive the conversation toward a more just and equal society.

Click on our “Reader Feedback”. Please let us know how our content has inspired you. Submit your testimonial and help shape the conversation today!

Additionally, leave a comment about this article below.

Support Social Justice Australia – Help Keep This Platform Running

Social Justice Australia is committed to delivering independent, in-depth analysis of critical issues affecting Australians. Unlike corporate-backed media, we rely on our readers to sustain this platform.

If you find value in our content, consider making a small donation to help cover the costs of hosting, maintenance, and continued research. No matter how small, every contribution makes a real difference in keeping this site accessible and ad-free.

💡 Your support helps:

✅ Keep this website running without corporate influence

✅ Fund research and publishing of articles that challenge the status quo

✅ Expand awareness of policies that affect everyday Australians

💰 A one-time or monthly donation ensures Social Justice Australia stays a strong, independent voice.

🔗 Donate Now

Thank you for being part of this movement for change. Your support is truly appreciated!

Where the worship of money has overcome the worship of God

Hi David,

Thank you for your comment. The phrase “Where the worship of money has overcome the worship of God” reflects a broader critique of how economic policies and neoliberal ideologies have prioritised wealth accumulation over social well-being. The shift towards privatisation, deregulation, and austerity—often promoted by institutions like the World Bank and IMF—has led to a system where profit is valued over people.

Historically, many societies have upheld compassion, community welfare, and social responsibility as guiding principles. However, under neoliberal economic policies, these values have often been sidelined in favour of corporate interests and financial markets. This is evident in the privatisation of essential services, the commodification of education and healthcare, and the widening gap between the wealthy elite and ordinary citizens.

The good news is that alternatives exist. Public banking, debt-free education, stronger social safety nets, and investment in public services are ways nations can reclaim economic sovereignty and prioritise human dignity over unchecked capitalism.

What are your thoughts on restoring fairness and equity in our economic systems?