Description

Who controls our money? Discover how private banks create debt-based money and what Australia must do to reclaim monetary sovereignty. Learn the hidden truth.

Picture This: A Loan That Creates Money

It’s payday. Your wage hits your account. You breathe easier, for a moment. Then rent is due, groceries are up again, and your credit card balance hasn’t budged. But here’s something you may not know: the money in your account didn’t exist before someone, somewhere, went into debt.

Most Australians believe banks lend money that’s already in their vaults. Banks create money out of nothing when you take out a loan. They type numbers into your account and charge you interest for the privilege. It sounds unbelievable—until you look at how the modern banking system works.

This article explains how private banks create money, why this system is broken, and how Australia can reclaim its power to generate money for the public good, not private profit.

The Problem: How Banks Create Money—and Debt

Your Loan Is Their Profit

When you sign on the dotted line for a mortgage or personal loan, you might think you’re borrowing someone else’s savings. You’re not. The bank creates new digital money and deposits it into your account. This is known as credit creation.

Professor Richard Werner, who coined the term “quantitative easing,” has explained that banks don’t lend money—they create it. That money is now in the system, but it must be paid back with interest, which doesn’t yet exist in the economy.

“Each time a bank makes a loan, it creates new money.” — Bank of England

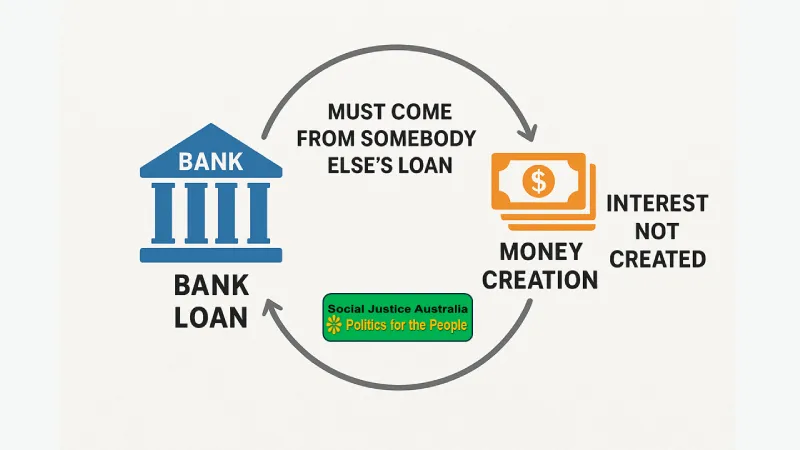

Where Does the Interest Come From?

Here’s the hidden catch: banks only create the loan amount (the principal)—not the interest you must repay. For example:

• You borrow $100,000.

• You repay $130,000 over time.

• But only $100,000 was created.

So, where does the extra $30,000 (the interest) come from?

It must come from new money created through someone else’s loan. More people, businesses, and governments must go into debt to keep the system running. This creates a constant need for:

• More borrowing

• More spending

• More economic growth

If borrowing slows down, there will not be enough money in circulation to pay off all loans plus interest. This will lead to defaults, recession, and economic stress.

In short, it’s a treadmill economy. We all must run faster to stay in place.

In-Transit Money: A Hidden Scam

Let’s rewind to the cheque-clearing era. A cheque deposited into Bank A could take days to clear from Bank B. During that lag, both banks could show the money in their books, lending it out and earning interest. It was being lent in two places simultaneously, and the borrower paid for the delay.

Today, even digital transactions can carry a one-day delay on balance sheets. This is deferred posting, and banks still profit from this phantom float.

A veteran of Australia’s banking sector, calls this “intransitu money“—a clever trick where banks create extra interest by manipulating posting times. Throughout billions of transactions, this adds up to a tidy hidden profit.

The Cost of Debt-Based Money

When all money is created through debt, it forces a treadmill economy. Governments, businesses, and households must always borrow more to keep the system running. If they don’t, the system contracts.

This leads to:

• Constant pressure to grow the economy.

• Asset bubbles, especially in housing.

• Widening inequality.

• Economic fragility.

And the kicker? Private banks decide who gets money, not the public. Their choices shape our economy more than Parliament ever will.

The Real-World Consequences

Debt Is a System—Not a Flaw

Picture a young couple in Brisbane. Both work full-time, yet they’re barely scraping together a deposit. Banks are happy to lend them $800,000 for a modest home, but that money didn’t exist until they agreed to spend the next 30 years paying it back.

Millions of Australians share their stories, stuck in a cycle of mortgage stress, student debt, and stagnant wages, all while bank profits soar.

Inflation and the Cryptocurrency Illusion

Now add digital currencies into the mix. Unlike public money, cryptocurrencies are backed by nothing but speculation. The cash used doesn’t disappear when people buy it—it stays in circulation. Meanwhile, the new asset drives up prices in yet another bubble.

Even worse, some forms of digital currency are being sold as stable alternatives without real asset backing, increasing risk, and fuelling inflation.

Debt-Free Public Money

What Is Debt-Free Money?

Debt-free money is currency created by the government—not banks—without the need to pay it back with interest. In Australia, this means the federal government, which is the sovereign issuer of the Australian dollar, can create money to fund public goods.

This is not a fringe idea. Australia used to do this through public works and services. Government salaries were paid using money created without bank debt. Projects like the Snowy Mountains Scheme, public schools, hospitals, and rail were built this way.

Public Banking and Monetary Sovereignty

A public bank, owned and run by the government, could lend for social benefit, not profit. It could support:

• Affordable housing projects

• Infrastructure

• Renewable energy

• Local business loans

Other nations have done this successfully

• The Bank of North Dakota has outperformed private banks for over a century.

• China’s state-owned banks fund long-term planning, not just quarterly profits.

Australia has the monetary sovereignty to do this—but our politicians act like household accountants chasing budget surpluses.

“A budget surplus may look good politically, but it withdraws money from the economy—just when people need it most.”

Digital Currency: Risk or Opportunity?

The Cryptocurrency Bubble

Digital currencies like Bitcoin and Ethereum have no intrinsic value. Their prices are driven by hype and speculation. Worse, when people convert their dollars into crypto, they remain in circulation, adding to inflation.

Digital assets are not inherently bad, but they become tools for wealth extraction and market manipulation without public oversight and proper backing.

China’s Digital Yuan – A Different Model

China is pioneering a digital yuan that is:

• State-controlled.

• Asset-backed, including gold reserves.

• Designed for public use, not profit.

This alternative model offers a public digital currency that replaces debt-driven and speculative systems.

Ref: https://madeinchinajournal.com/2023/11/27/the-digital-yuan-purpose-progress-and-politics/

Could Australia do the same? Yes—if it chooses people over profit.

Reclaiming Our Future with Debt-Free Money

Australia’s current banking system puts private profits before public needs. It creates money through debt, enriches banks through hidden mechanisms, and leaves ordinary citizens stressed, overworked, and overcharged.

But there’s a way forward:

• Create debt-free money for public benefit.

• Establish public banks to fund real needs.

• Use monetary sovereignty to invest in the future.

• Reject the illusion of unbacked digital currencies.

Our economy should work for us—not the other way around.

Q&A Section

Q1: Isn’t printing money inflationary?

Only when the economy is at full capacity. When there’s unemployment and underused resources, public money boosts productivity and demand—without causing inflation.

Q2: How would a public bank help?

Public banks lend at lower interest, focus on community needs, and return profits to the public—not shareholders.

Q3: Can digital currency work for the public?

Yes—if it’s publicly managed, asset-backed, and transparent. A digital Australian dollar could serve the people, not speculators.

Have Your Say

Have you or someone you know felt trapped by Australia’s debt-based system? Or struggled with inflation while banks made record profits? Share your experience below.

Call to Action

If you found this article insightful, explore more about political reform and Australia’s monetary sovereignty at Social Justice Australia: https://socialjusticeaustralia.com.au

Share this article with your community to help drive the conversation toward a more just and equal society.

Click on our Reader Feedback menu: Submit your testimonial and help shape the conversation today.

Support Social Justice Australia – Help Keep This Platform Running

Social Justice Australia is committed to delivering independent, in-depth analysis of critical issues affecting Australians. Unlike corporate-backed media, we rely on our readers to sustain this platform.

If you find value in our content, consider making a small donation to help cover the costs of hosting, maintenance, and continued research. No matter how small, every contribution makes a real difference in keeping this site accessible and ad-free.

💡 Your support helps:

✅ Keep this website running without corporate influence

✅ Fund research and publishing of articles that challenge the status quo

✅ Expand awareness of policies that affect everyday Australians

💰 A one-time or monthly donation ensures Social Justice Australia stays a strong, independent voice.

If you believe in the power of independent voices to inform and inspire change, please consider supporting Social Justice Australia today. Even a small contribution helps us stay independent and continue delivering high-quality analysis on the issues that matter most.

I am deeply grateful for your support and for standing with us in this important movement for truth and justice.

Thank you for being part of this movement for change. Your support is genuinely appreciated!

Wondering if there could be references to the way banks produce money for loans from thin air I suspect many people would need some convincing?

Hi Ian,

Absolutely — and you’re right to ask. It sounds unbelievable initially, but central banks and economists confirm it.

When banks issue a loan, they don’t lend existing money — they create new money by entering numbers into your account. This process is called credit creation.

Even the Bank of England explained this clearly in a 2014 report:

“When a bank makes a loan… it credits the borrower’s bank account with a deposit of the size of the loan. At that moment, new money is created.”

— Bank of England, “Money Creation in the Modern Economy”

Read the full paper here. https://www.bankofengland.co.uk/quarterly-bulletin/2014/q1/money-creation-in-the-modern-economy

Similarly, the Reserve Bank of Australia (RBA) has acknowledged this in its publications, though less directly. It explains that private banks increase the money supply when issuing loans, limited mainly by regulations and profitability, not deposits.

Economist Richard Werner, who coined the term “quantitative easing, ” provides a great explanation. He conducted empirical research showing exactly how banks create money.

It’s a significant shift in understanding, but once you see how it works, it raises serious questions about who controls money and why governments don’t just create money directly for the public good.

Happy to share more references if you’re interested!